About Us

AREIT, Inc.

AREIT Inc. (AREIT) was incorporated as a real estate company on September 4, 2006. It was initially known as One Dela Rosa Property Development, Inc. before changing to its current name on April 12, 2019.

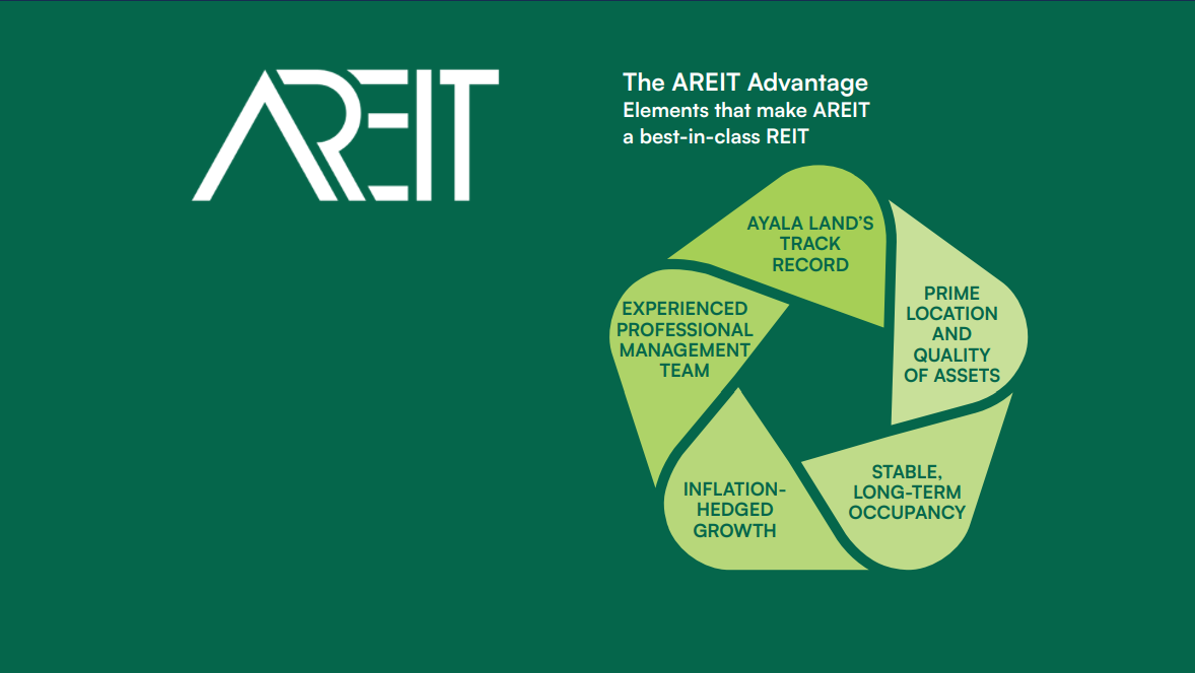

AREIT is the first Real Estate Investment Trust (REIT) in the Philippines, formed primarily to own and invest in an income-generating commercial portfolio of office, retail, hotel, and industrial land properties in the country that meets its investment criteria. When the opportunity arises, it may explore other types of real estate properties available in the market.

AREIT offers an investment opportunity with a stable yield, distributing at least 90% of its distributable income from high-quality properties with strong tenant demand in its portfolio. Solid sponsor support and highly experienced fund and property management companies, AREIT Fund Managers, Inc. (AFMI) and AREIT Property Managers, Inc. (APMI), respectively, provide the potential for revenue and income growth.

As of March 31, 2025, 38.29% of the Company is publicly traded, with the balance owned by Ayala Land, Inc. and its subsidiaries.

AREIT Corporate Video

Fast Facts

First and Largest Philippine REIT

Testing unchartered waters of REITs in the Philippines, AREIT being the first, deliberately started small but with a firm belief that the REIT should serve as fuel for real estate growth. As of full-year 2024, AREIT’s gross leasable area (GLA) stands at 3.9 million sqm with Assets Under Management (AUM) valued at P117B making it the largest REIT in the nation.

Highly-Diversified Portfolio

AREIT’s AUM is composed of 76% offices, 11% retail, 6% hotels, and 7% industrial land. In terms of location, 56% are in the Makati CBD, 18% in other prime locations in Metro Manila, 12% in Cebu, 13% in Luzon, and 1% in Visayas.

Uninterrupted Dividend Growth

AREIT’s quarterly dividends have steadily increased since its August 2020 IPO, with a remarkable 107% dividends per share (DPS) growth over 20 quarters, an average quarter-on-quarter growth of 3.9% due to stable operations and accretive asset infusions providing a total shareholder return (TSR) since IPO of 81% as of end-2024.

Vision & Mission

Our vision is to be the premier and leading Real Estate Investment

Trust in the Philippines with a balanced portfolio providing stable returns and long-term growth.

Our mission is to deliver excellent real estate and an investment strategy that creates

sustainable value for our customers, locators, stakeholders, and the relevant

communities we serve.